How to Find the Best Smallcap Stocks Today

These are good times for smallcaps.

I maintain a watchlist of stocks I track and have recommended.

I'm not exactly happy.

That's because it feels too good to continue. Markets move in cycles.

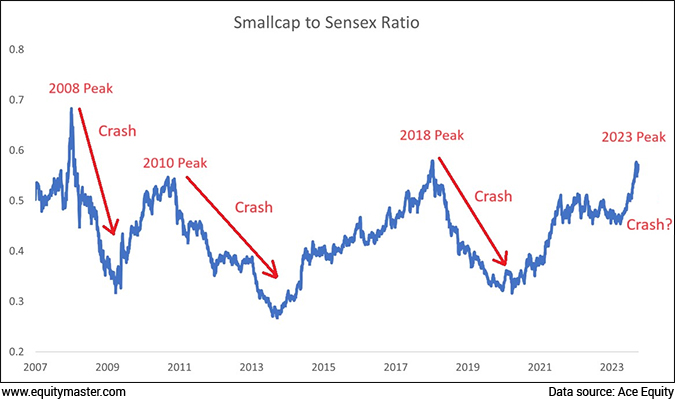

More than a decade ago, the surge in the smallcap index was followed by an 80% crash, in just over a year.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

----------------------------------------

It took more than 8 years for the BSE Smallcap Index just to reach its previous high.

I believe a lot of popular and good quality smallcap businesses may not turn out to be great investments if bought at these levels. What more bad choices could lead to a loss of the initial investment.

The smallcap to Sensex ratio is at 0.61 versus a long-term median of 0.43.

Over the last few days, the ratio has inched up from previous peak of 0.58x in January 2020. From that peak, what followed was a big correction in the index. It took over 3 years for smallcap index to touch the previous peak again.

Yet, this exuberance may continue for some more time.

That's because an unprecedented amount of money has, and continues to, chase this space.

Trillions of rupees have found way to smallcaps through mutual funds. In a lot of cases, it is beyond the capacity of smallcaps. This heavy flow is not sustainable.

Smallcap funds simply cannot invest Rs 30-50 bn worth of inflows they're getting every month. Many smallcap stocks don't have the liquidity to handle large trading volumes.

No wonder then some of the fund houses managing huge amounts of money have closed their doors to fresh investments into their smallcap schemes.

So, how should investors navigate smallcaps in this scenario?

The famous poet - Robert Frost has the answer.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

What You Need to Know Before Investing in Small Businesses

Read this letter before you invest in small companies

Read Now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

The Road Not Taken...

That's the title of one of his most popular poems, the gist of which could be captured in these lines.

- "Two roads diverged in a wood, and I-

I took the one less traveled by,

And that has made all the difference"

Let me explain its relevance in the context of investing in smallcaps.

The huge institutional money finding its way to smallcaps has divided the smallcap universe into two distinct zones.

The first zone is that you keep reading about in the media... that keeps triggering the FOMO (fear of missing out) in you.

This is the zone with all the hyped stocks, most of which have already run up too much too fast.

Now let's look the other lot - the ignored zone.

This is the road that smart money won't take, not yet. That's because the trading values and volumes in these stocks are too low to accommodate the appetite of institutional money.

However, as an individual investor, that limitation does not exist for you. Even as the information asymmetry is narrowing down between big and small investors in the age of digitisation.

That is not to say that these ignored stocks will face no correction in case of a market crash.

But given a better margin of safety in the entry price of these stocks, the long-term wealth creation potential is likely to be better in these stocks.

For instance, in the correction of 2018, quite a few ignored stocks like Persistent Systems, Garware Technical Fibers, and Deepak Nitrite, turned out to be multibaggers.

Overtime, these stocks moved from ignored zone to popular zone with rerating potential or expansion in PE multiples, and solid business potential.

The stocks in the popular zone have very limited scope of further PE expansion. In fact, it's quite possible they might face a derating. However, this phenomenon could unfold differently for ignored stocks.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

This Silvery-white Metal is a Potential Fortune Maker

This silvery-white metal goes inside almost all the electronic gadgets that you use: mobile phone, laptop, Bluetooth speakers.

Not only that... this metal also goes inside equipment used by large data centres, telecom towers, railways, planes, EVs.

We're talking about Lithium. Lithium is the new oil.

Our research has found the best way to tap into this rising demand of lithium in India.

See Details Here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------

As such, while it might feel safe to copy smart money in these times, it could be a big mistake. You would likely be buying the expensive stocks with this strategy.

Here's some data to back this up.

My team and I analysed data of 1,744 companies listed on the BSE stock exchange. These companies classify as smallcap companies.

Now, for all these 1,744 companies we looked at the data of institutional holding... especially holdings of mutual funds.

We found that wherever mutual funds and other institutional holding was more than 20% of the stock... those stocks had median Price to Earnings or PE ratio of 33.78.

Whereas for stocks where institutional holding was less than 20%... this figure was 25.54.

Now that's a significant difference. This means stocks with heavy mutual fund and other institutional holdings are very expensive.

Whereas stocks where there is less to no mutual fund holding are available at reasonable valuations.

It goes without saying that you should not be making decisions just based on institutional holdings. You need to assess the quality of business and management in the ignored zone.

But it is this ignored bucket where chances of finding a good business at attractive valuations are higher.

To know more about such smallcap companies, click here.

Warm regards,

Richa Agarwal

Editor and Research Analyst, Hidden Treasure

Recent Articles

- This Transformer Stock is About to Hit Rs 10,000. Is it Still Value for Money? April 27, 2024

- To scale up renewable energy generation in India, this company is looking to open more centres in India.

- Stocks Profiting from the Rise of the Luxury Class in India April 26, 2024

- These stocks benefit the most from the growing opulent class in India.

- A Rare Opportunity to Profit from Pharma Stocks April 25, 2024

- This opportunity can create a lot of wealth. Keep an eye on it.

- Why CE Info and Netweb Technologies Can Go Where NVIDIA Can't... April 24, 2024

- A 100-day programme will look for companies that can fortify India's deeptech foray.

Equitymaster requests your view! Post a comment on "How to Find the Best Smallcap Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!